Article

Registration Requirement under the Common Reporting Standard (CRS)

Article

Registration Requirement under the Common Reporting Standard (CRS)

December 11, 2025

6 minute read

Trustees and Directors beware! – a new Mandatory Registration Requirement under Automatic Exchange Of Information has been introduced with a deadline of 31st December 2025 and a potential penalty for late registration of up to £1,000.

Trustees and Directors beware! – a new Mandatory Registration Requirement under Automatic Exchange Of Information has been introduced with a deadline of 31st December 2025 and a potential penalty for late registration of up to £1,000.

The government is introducing regulations to bring in updated rules for the OECD’s Common Reporting Standard, and to improve the effectiveness of the UK’s implementation of the CRS and USA’s Foreign Account Tax Compliance Act (FATCA).

This places obligations on Financial Institutions to:

- Identify accounts maintained for specified persons to help tackle tax evasion; and

- Collect and report information in a specified manner to HM Revenue and Customs (HMRC).

But the definition of a “Reporting Financial Institution” is extremely wide and will catch many trusts, investment companies and partnerships where more than 50% of their gross income is attributable to investing, reinvesting or trading in financial assets (referred to as the “financial assets test”). Financial assets are widely defined, but do not include direct interests in real property or cash.

Such entities are likely to be caught under the definition of “Managed Investment Entities” and are within this new registration and reporting requirement if they are ‘managed by a Financial Institution’, i.e. a Financial Institution has discretionary authority, either directly or through another service provider, to manage the entity’s assets at least in part and the entity meets the financial assets test above.

Common examples:

Investment Partnership

Investment Partnership LLP is a vehicle set up to invest its members’ contributions in financial assets, it invests in its own right and has no customers. The LLP’s investments are managed by Invest Co Ltd, a Financial Institution. The LLP has been investing for several years and its income is derived exclusively from its investment activities. As the LLP is managed by a Financial Institution and at least 50% of its income in the last three years is primarily attributable to investing, reinvesting or trading in financial assets it will be an Investment Entity and a Reporting Financial Institution.

Family trust with a corporate trustee

The ABC family trust’s gross income is primarily attributable to investing, reinvesting or trading in financial assets. The trust was set up on the advice of a law firm and that firm’s own corporate trustee is the trustee of the trust. The corporate trustee acts for the law firm’s clients without itself charging any fees to the clients. Even though the corporate trustee does not charge, it is a Financial Institution by virtue of being an Investment Entity. Its Related Entity (the law firm) is charging the clients for the corporate trustee’s services of managing assets, the corporate trustee therefore primarily conducts as a business, for or on behalf of a customer, the prescribed activities. This in turn means that the ABC family trust is an Investment Entity and a Reporting Financial Institution.

Trust with an investment portfolio

XYZ Trust holds some properties and a portfolio of stocks and shares, the latter managed by a large investment management firm. More than 50% of its gross income comes from the share portfolio which is under a discretionary management mandate, with the fund manager advising on investment strategy. Because the XYZ Trust has part of its assets managed by a Financial Institution it is itself therefore a Managed Investment Entity and a Reporting Financial Institution.

Family Investment Company

FIC Limited has a portfolio of investments which generates the majority of its income. As with the XYZ Trust above these are managed on a discretionary basis by an investment management firm. As such, FIC Limited is an Investment Entity and a Reporting Financial Institution. If the directors of FIC Limited invested in retail investments and made all decisions on what investments to make, the arrangement would not amount to discretionary management.

Trustee-Documented Trust (TDT)

A TDT is a trust that is a Financial Institution where the trustee of the trust is itself a Reporting Financial Institution and reports all the information required in respect of the Reportable Accounts of the trust. In such a case, a TDT is a Non-Reporting Financial Institution, however, it is still required to register for the Automatic Exchange Of Information by the later of 31 December 2025 or 31 January following the calendar year in which they first fall within the definition of TDT for FATCA or CRS purposes.

How to Register

In order to register for the Automatic Exchange Of Information (AEOI) under the CRS you will need to have a Government Gateway user ID and password. If you do not have a user ID, you can create one when you use the service.

You must select ‘organisation’ as your account type to register for AEOI.

You must select ‘no’ when you are asked if you have registered for AEOI before.

To complete your registration, you’ll need to provide the:

- organisation name and first name and last name of contact in the financial institution

- telephone number

- email address

- Global Intermediary Identification Number (GIIN) if reporting under the Foreign Account Tax Compliance Act (FATCA) for the USA — if no GIIN is held use 000000.00000.LE.000

- Unique Taxpayer Reference (UTR), National Insurance number or indicate that the Reporting Financial Institution has no UK tax identifier

- address of their principal place of business

When registering a Trustee-Documented Trust, the Trustee-Documented Trust should be shown as the Reporting Financial Institution, not the trustee. The reporting trustee should be named as a contact.

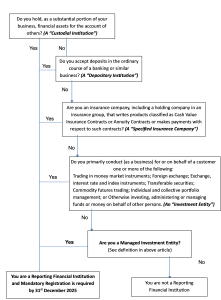

The following flowchart illustrates the definition of Reporting Financial Institutions:

What next?

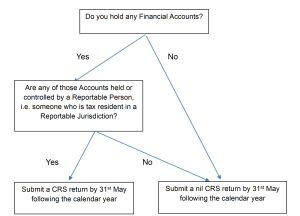

Once registered, an annual report may be required. Whilst this article does not cover the reporting requirements in detail, the broad principle is as follows:

If an entity registers for the AEOI service and has no Reportable Accounts, there is currently no obligation to submit a nil return each year, although the entity may choose to do so. Therefore, entities with sole UK residence, without connection to other jurisdictions (i.e. all persons connected with the entity are also UK resident), do not need to submit an annual CRS return.

Related content

Need expert advice?

Speak to an expert for advice on

+44-1865 292200 or get in touch online to find out how Shaw Gibbs can help you

Email

info@shawgibbs.com

Need expert advice?

Speak to an expert for advice on

+44-1865 292200 or get in touch online to find out how Shaw Gibbs can help you

Email

info@shawgibbs.com